Prediction markets are gambling... right?

Technically, yes. But they might also be the future of risk management.

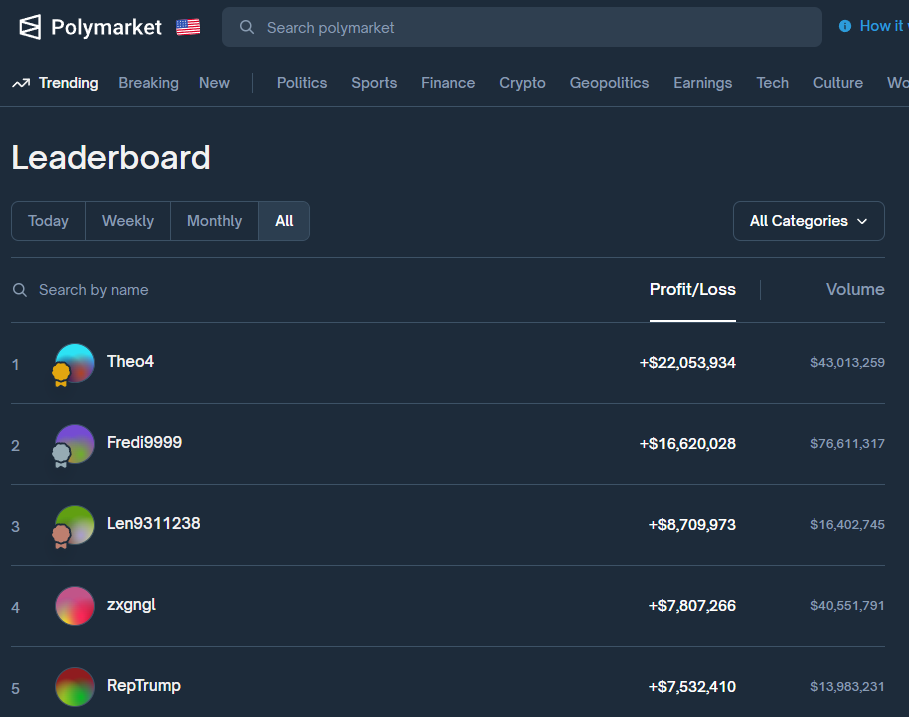

Top traders make a lot of money in prediction markets. Both Polymarket and Kalshi have public leaderboards where you can see the millions top traders have stacked up.

Recently, 60 Minutes ran a feature on a popular prediction market user named ‘Domer’, who detailed his philosophy to gain an information edge in the markets and remain profitable. In the interview, Domer sounded remarkably like a seasoned investor, yet the reporting still referred to him as a “bettor” and his trading decisions as “wagers.”

This begs the question: Is Domer investing or gambling?

How do investing and gambling compare?

The core tenets shared by both include:

Committed Stake:

Capital is put at risk.

Uncertainty

The outcome is not guaranteed.

Risk vs. Reward

There is a calculated or perceived potential for gain.

The core differentiators are as follows:

Zero-sum

Investing can grow wealth for all participants. Gambling is zero-sum, and negative-sum for its participants (after fees).

Intrinsic value

Investments are based on productive, value-generating assets. Gambling markets have zero underlying value.

Risk structure

Investments have controlled risk exposure. Gambling is all or nothing.

Skill vs Luck

Investments can be skillfully made with smart decision making. Gambling is a game of luck.

Bridging the gap

The world isn’t black and white; a grey area exists between pure investing and pure gambling. Using the four differentiators above, we can view these activities on a spectrum.

The verdict? Becuase they are binary and zero-sum, prediction markets lean toward gambling.

So prediction markets are nothing but gambling?

Not exactly. While current volumes are driven primarily by sports betting, the institutional interest tells a different story. When Intercontinental Exchange (ICE), the owner of the NYSE, invests heavily in this space, it’s because they see utility beyond the "wager."

The Benefits of Prediction Markets

Information Aggregation

Prediction markets are often more accurate than polls or pundits because participants face a financial penalty for being wrong. This creates a “truth-seeking” mechanism that aggregates fragmented information into a reliable price.

A recent study by Kalshi Research highlights this:

Superior Accuracy: Between 2023 and 2025, prediction market forecasts for inflation (YOY CPI) showed a 40.1% lower mean absolute error than traditional economist consensus.

Predicting the Unpredictable: During “shocks” (major unexpected economic shifts), markets outperformed experts by 50% to 60%.

Disagreement as a Signal: When the market price deviated significantly from economist predictions, the market was right 75% of the time.

New Financial Instruments

Traditional finance often forces investors to hedge risks indirectly. If you were worried about Brexit in 2016 (which gamblers predicted before traders on Betfair), you had to buy complex exotic products or trade currency pairs like GBP/USD. These are noisy proxies, as the pound could drop for a dozen reasons unrelated to the vote.

Prediction markets allow for direct exposure:

Precision: Instead of buying a hotel stock to bet on a travel rebound, you buy a contract directly on “Will COVID cases decrease?” This removes “CEO risk” or broader market volatility.

Democratization: Historically, only firms like Goldman Sachs or Bridgewater could structure complex hedges for political events. Prediction markets give every participant the ability to “insure” their portfolio against specific geopolitical or economic outcomes.

Prediction Markets: A Utility in Search of Maturity

While outputs of prediction markets (like accurate forecasts and surgical hedging) can be framed as sophisticated financial utilities, the daily reality of these platforms is often much messier.

Currently, the industry faces significant regulatory headwinds. Additionally, many markets suffer from thin liquidity, which can skew “the wisdom of the crowd” into the “whims of a few whales.” Finally, the vast majority of volume remains concentrated in high-adrenaline event betting (especially sports betting) rather than the sober economic hedging described by exchange founders.

So yes, prediction markets are gambling. But they aren't only gambling. They represent a new technological tool for an old human habit. If these platforms can survive the regulatory gauntlet and fix their liquidity issues, they could move beyond "wagers" to become the standard for pricing global risk. For now, they remain a hybrid: a casino for some, and a glimpse into the future of risk management for others